It is used for purchase and sales return under VAT. We can also adjust VAT return with purchase and sales transaction.

Working steps:-

Create a company and then activate VAT:

To Activate VAT: - G.O.T. (Gateway of Tally)--> Press F11 (Company Features)--> Press F3 (Statutory & Taxation).

And then create ledger:

Path for ledger creation: - G.O.T. (Gateway of Tally)--> Accounts Info--> Ledger--> Create (Single).

After that, create stock master as follow:

To create stock group: - G.O.T. (Gateway of Tally)àInventory Infoà Stock Groupà Create (Single).

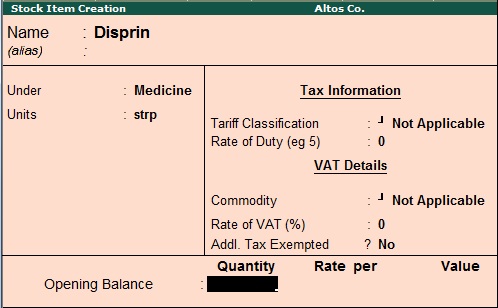

To create stock item: - G.O.T. (Gateway of Tally)--> Inventory Info--> Stock Item--> Create (Single).

And then do voucher entry as follow:-

Path for voucher creation: - G.O.T. (Gateway of Tally)--> Inventory Voucher--> Press F9 (Purchase Voucher).

Now activate debit and credit note:

To Activate Debit and Credit Note: - G.O.T. (Gateway of Tally)--> Press F11 (Company Features)--> Press F1 (Accounting Features).

Again do voucher entry as follow:-

Now you can see the VAT report.

Path for view VAT report: - G.O.T. (Gateway of Tally)--> Display--> Statutory Report--> VAT Report--> VAT Computation.

Press “Alt + F1” for more details.

No comments:

Post a Comment